How does Squid use liquidity pools?

Squid supports swapping any to any token across all the chains it supports, utilising existing liquidity.

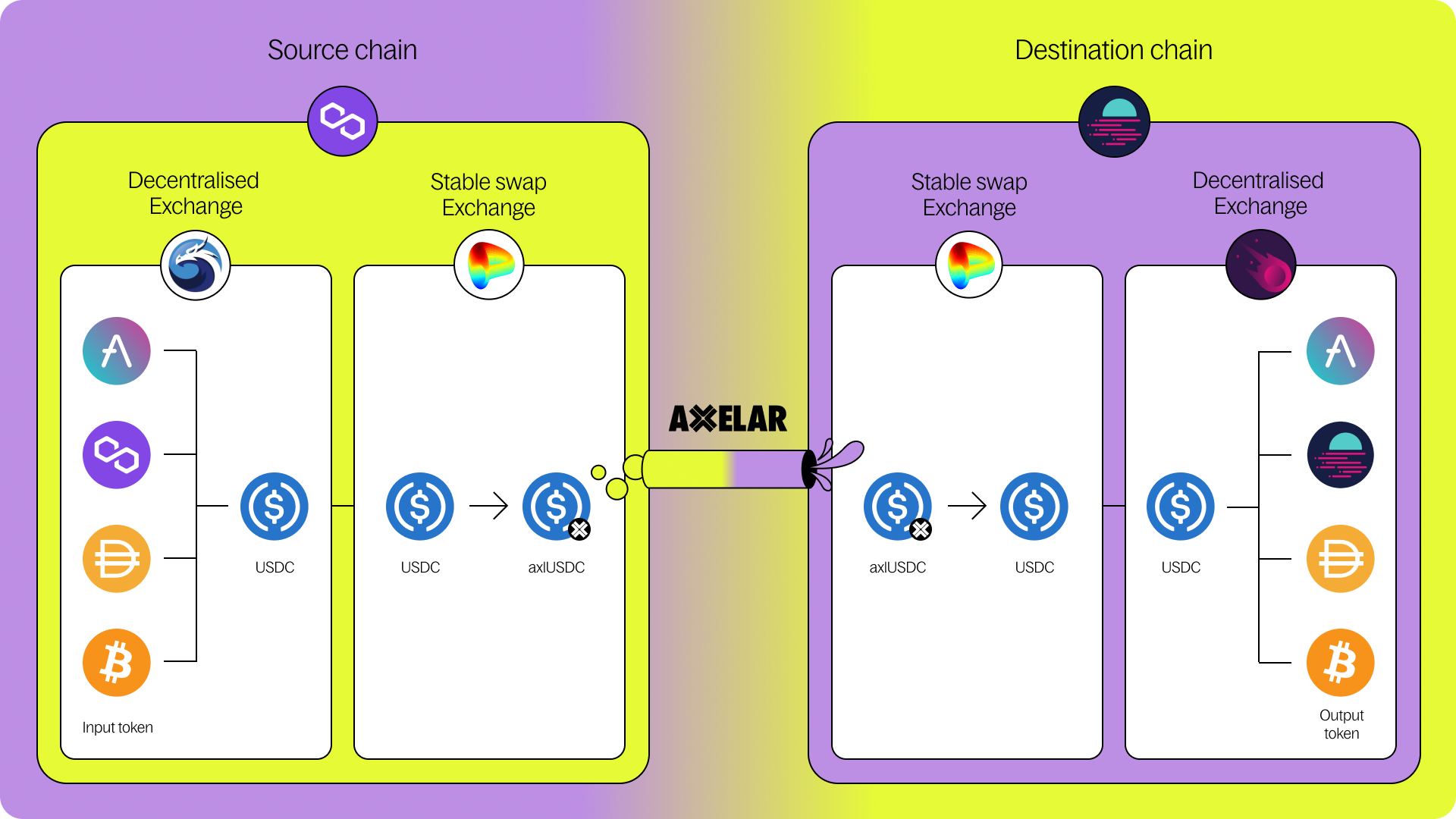

Cross-chain EVM swaps

Squid routes all its transactions through routing tokens such as axlUSDC or frxETH, utilizing stable swap pools and native token pools on standard AMMs.

This approach leverages the deep liquidity between these routing tokens and nearly all other tokens in crypto, minimizing the number of liquidity pools that need to be capitalized to achieve efficient liquidity across every token.

Every swap using Squid is a combination of the below:

- Swap ERC20 → native USDC (eg. on Uniswap)

- Swap native USDC → routing token (eg. axlUSDC on Curve)

- Bridge routing token → routing token (via Axelar)

- Swap routing token → native USDC (eg. on Curve)

- Swap native USDC → ERC20 (eg. on Uniswap)

- Depending on the input or output desired, Squid will build and execute a selection of the above steps (in order).

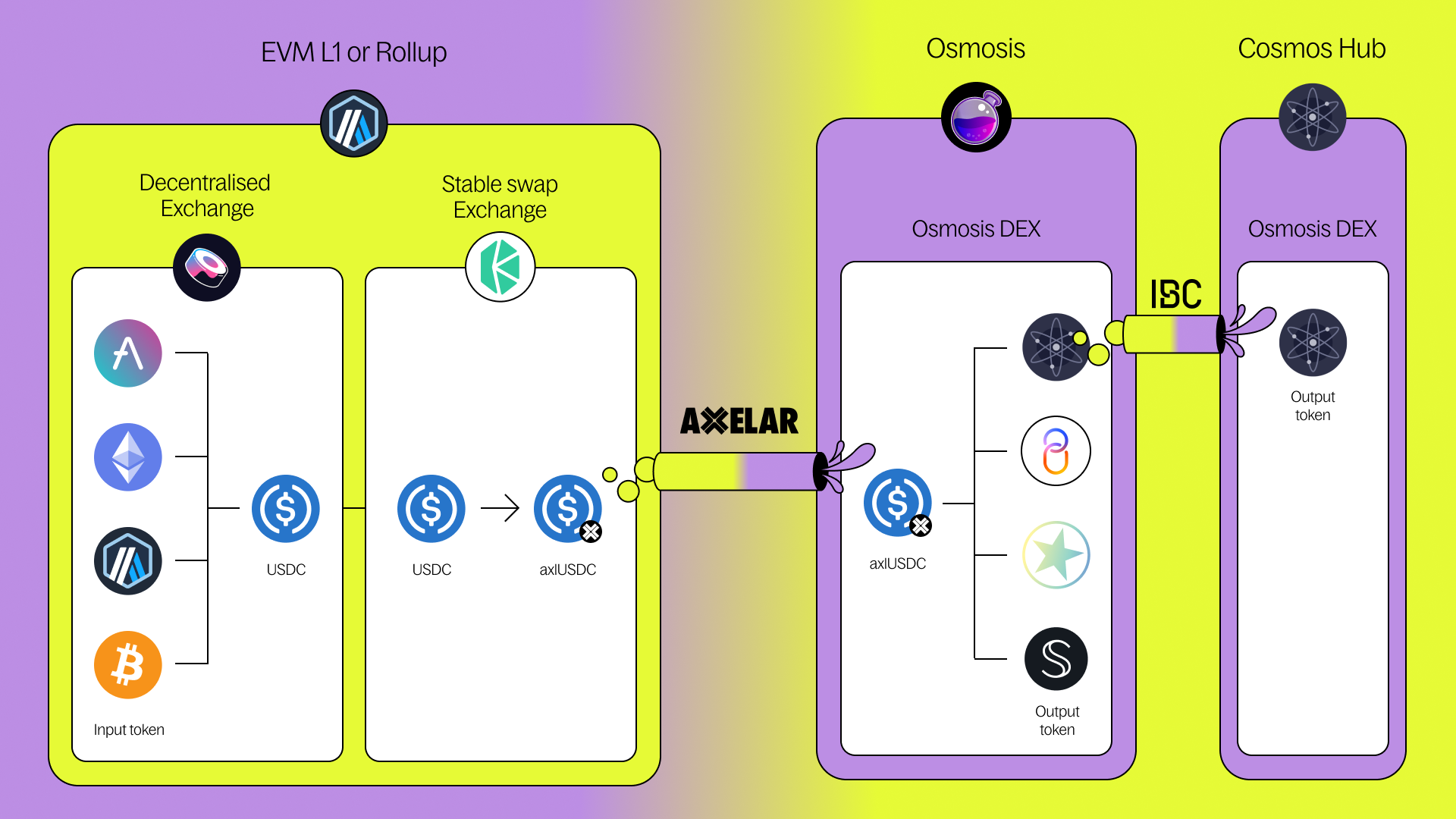

Cross-chain Cosmos swaps

When moving from EVM ↔ Cosmos, Squid uses Axelar to move assets to or from Osmosis, where the majority of Cosmos liquidity is. After this, Cosmos assets are routed across Cosmos chains via IBC.